How to Invest in Cryptocurrency – Beginner’s Guide for 2025

your simple starting point to enter the world of digital money. As more people look for smart, modern ways to grow their savings, cryptocurrency offers exciting opportunities—but also real risks. This guide is designed to help you understand the basics, avoid mistakes, and invest with confidence, even if you’re completely new to crypto.

What Is Cryptocurrency?

f you’re learning how to invest in cryptocurrency, the first step is to understand what cryptocurrency really is.

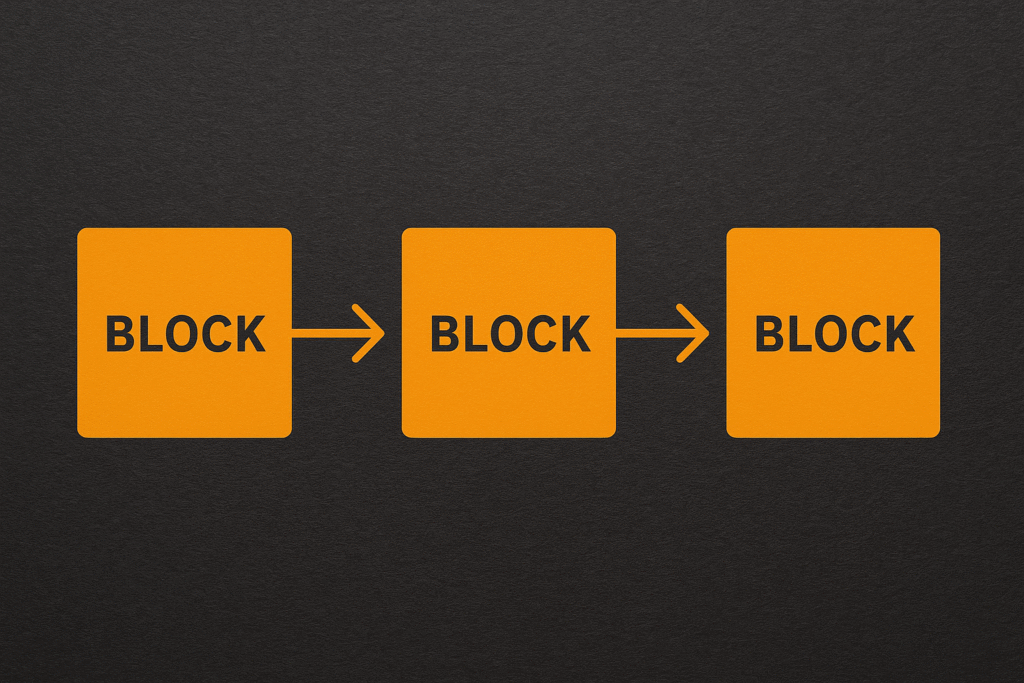

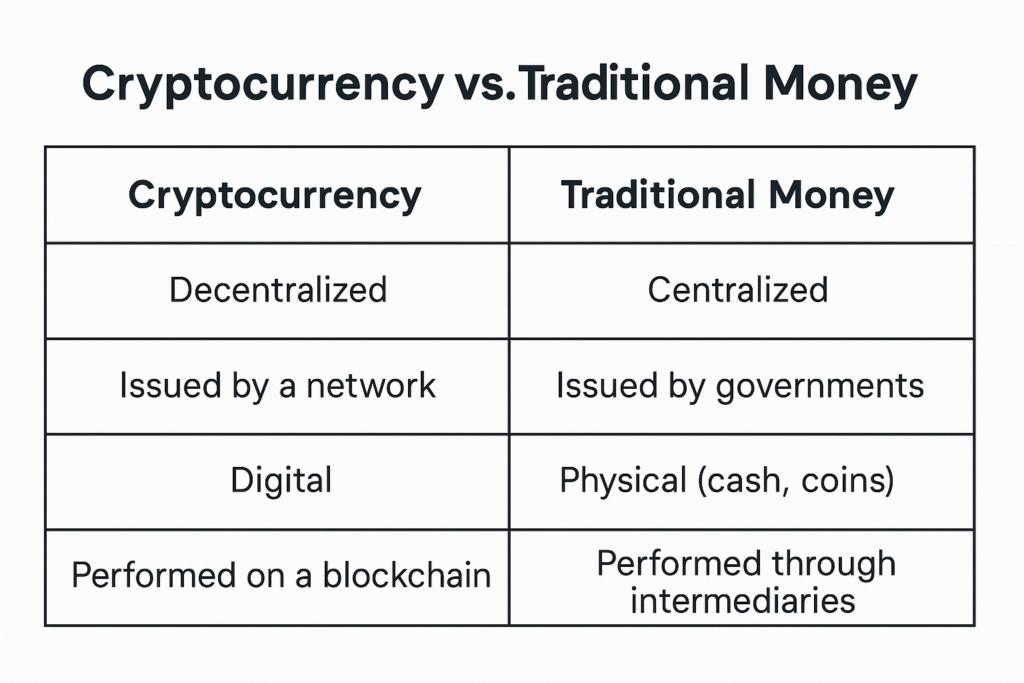

Cryptocurrency is a form of digital money. Unlike cash or credit cards, it isn’t issued by a government or controlled by banks. Instead, it operates through a special technology called blockchain—a secure system that records every transaction in a public, unchangeable ledger.

The most popular cryptocurrencies are:

- Bitcoin (BTC) – The first and most valuable digital currency

- Ethereum (ETH) – Known for its smart contract capabilities

- Tether (USDT) – A stablecoin linked to the U.S. dollar

Cryptocurrencies can be used to:

- Buy and sell goods or services

- Send money quickly anywhere in the world

- Store value or grow investment

- Access new financial technologies like DeFi (decentralized finance)

What makes cryptocurrency powerful is that you control your money directly, without needing a bank or approval from a third party.

Why Should You Invest in Cryptocurrency?

If you’re wondering how to invest in cryptocurrency, the next question you might ask is: why should I invest at all? The answer depends on your financial goals, but many people are choosing crypto because of its unique benefits compared to traditional money.

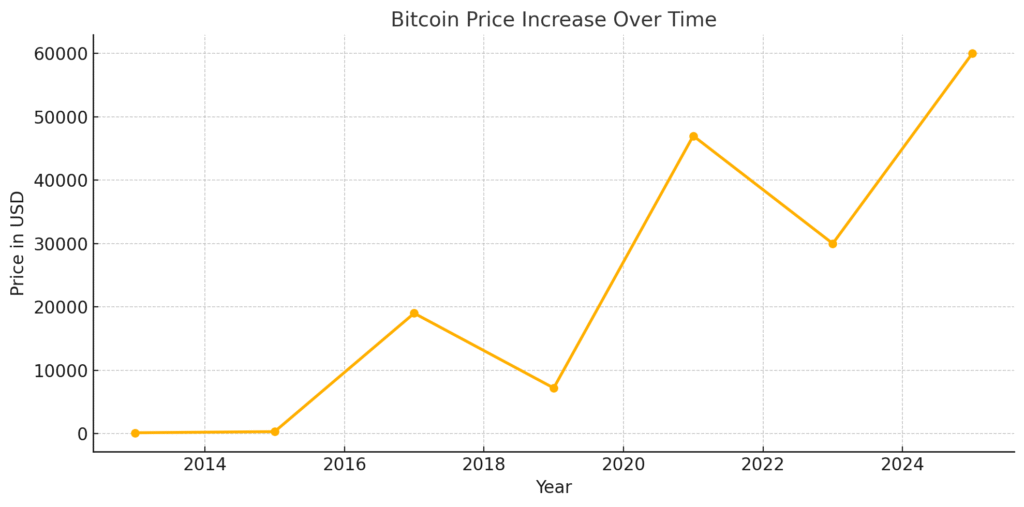

🚀 1. High Growth Potential

Cryptocurrency prices can grow quickly. Bitcoin, for example, started at a few cents and reached tens of thousands of dollars. While it’s risky, early investors have made huge profits. If you’re patient and make smart choices, crypto can offer long-term growth.

🌍 2. Global and Borderless

Crypto can be sent or received anywhere in the world in minutes. No need for banks, no waiting for business hours, and no expensive transfer fees. It’s perfect for people in countries with limited access to banking.

🔐 3. You Control Your Money

When you invest in cryptocurrency, you are your own bank. You hold your private keys. There are no middlemen. You don’t need permission to send, receive, or save money.

This gives you more control and freedom over your finances.

💼 4. A New Way to Diversify

Smart investors don’t keep all their money in one place. Crypto gives you a new option outside of cash, gold, or stocks. It’s a diversification tool that can protect your wealth against inflation or market crashes.

💡 5. Innovation and the Future

Investing in cryptocurrency means you’re also supporting new technologies:

- Decentralized finance (DeFi)

- Smart contracts

- Web3

- Blockchain-based apps

✅ Summary

You should invest in cryptocurrency because it gives you:

- High return possibilities

- Full control over your funds

- Access to a global market

- Exposure to future financial technology

Just remember: like any investment, crypto carries risks. Always do your own research and never invest more than you can afford to lose.

How to Invest in Cryptocurrency (Step-by-Step)

Step 1: Learn the Basics

Before you put any money into crypto, take some time to understand how it works:

- What is a coin vs. a token?

- What is blockchain?

- What are wallets and exchanges?

There are free resources like YouTube, blogs, and guides that can teach you fast.

Step 2: Choose a Secure Wallet

You need a crypto wallet to store your digital coins.

There are two main types:

- Hot Wallets (online): Easy for beginners (e.g., Trust Wallet, MetaMask)

- Cold Wallets (offline): Safer for large amounts (e.g., Ledger, Trezor)

Step 3: Register on a Trusted Exchange

A crypto exchange is where you buy and sell cryptocurrencies.

Popular and beginner-friendly platforms include:

- Binance

- Coinbase

- KuCoin

Sign up, verify your identity, and link your bank card or mobile wallet.

Step 4: Buy Your First Crypto

Start small. Buy $10 to $20 worth of:

- Bitcoin (BTC)

- Ethereum (ETH)

- Or stablecoins like USDT

This helps you learn how buying and holding works — without risking too much.

Step 5: Track and Secure Your Investment

After buying:

- Move your coins from the exchange to your wallet

- Write down your recovery phrase and keep it safe (never share it)

- Enable 2FA (Two-Factor Authentication) for extra security

Tips for Smart Investing in Crypto

If you’re serious about learning how to invest in cryptocurrency, knowing how to do it wisely is just as important as knowing how to start. These tips will help you avoid mistakes, protect your funds, and grow your confidence as a crypto investor.

✅ 1. Only Invest What You Can Afford to Lose

Cryptocurrency is very volatile. Prices can go up fast—and drop just as quickly. Never invest money you need for food, rent, or school.

✅ 2. Do Your Own Research (DYOR)

Never invest just because a friend or influencer told you to. Read about the coin or project:

- What is its purpose?

- Who created it?

- Is it trusted and used?

✅ 3. Diversify Your Portfolio

Don’t put all your money into one coin. Spread your investment across 2–4 reliable cryptocurrencies. This reduces risk if one of them drops in price.

✅ 4. Store Your Crypto Safely

Once you buy your coins, move them to a secure wallet. Exchanges can be hacked. Use:

- Hot Wallets for short-term

- Cold Wallets for long-term

✅ 5. Avoid Emotional Decisions

Don’t panic when prices fall. Don’t rush when prices rise. Emotional decisions lead to big mistakes. Stick to your plan and be patient.

✅ 6. Stay Updated with the Market

Follow trusted crypto news sources and check your portfolio weekly. The more informed you are, the smarter your decisions will be.

News sources you can follow:

- CoinDesk

- CoinTelegraph

- CoinMarketCap

✅ Summary

Smart crypto investing is all about:

- Staying calm

- Doing research

- Using safe tools

- Thinking long-term

By following these simple tips, you’ll be one step ahead of most beginners—and on your way to becoming a confident crypto investor.

Common Mistakes to Avoid

When learning how to invest in cryptocurrency, it’s just as important to know what not to do as it is to know what to do. Many beginners make small mistakes that lead to big losses. Here are the most common crypto investing mistakes—and how to avoid them.

❌ 1. Investing Without Research

Never buy a coin just because it’s trending or someone on social media says it will “go to the moon.” Always research:

- The purpose of the coin

- The team behind it

- Real-world use cases

❌ 2. Putting All Your Money Into One Coin

Many beginners go “all in” on one cryptocurrency. If that coin crashes, they lose everything. A smart investor spreads money across 2–4 trusted projects.

❌ 3. Keeping Funds on an Exchange

Exchanges can get hacked or freeze withdrawals. Once you buy crypto, move it to your own wallet to stay in control.

❌ 4. Ignoring Security Basics

Not saving your seed phrase, sharing your private key, or clicking on suspicious links can wipe out your whole investment in seconds.

❌ 5. Letting Emotions Control You

Buying when you feel FOMO (fear of missing out) or selling in panic often leads to regret. Crypto requires patience, not panic.

✅ Summary

Avoiding these mistakes will save you money, time, and stress:

- Do your research

- Diversify your portfolio

- Store your crypto safely

- Protect your private information

- Stay calm and think long-term

Learning how to invest in cryptocurrency the smart way means avoiding these common traps from the start.

Final Thoughts

By now, you’ve learned the essential steps on how to invest in cryptocurrency—from understanding what crypto is to choosing a wallet, buying your first coin, and avoiding common mistakes.

Cryptocurrency can be a powerful tool to build your financial future, but only if you invest wisely. The key is to:

- Start small

- Stay consistent

- Keep learning

- Protect your funds

- Avoid emotional decisions

You don’t need to be an expert to get started. Every successful investor was once a beginner just like you. What matters most is your willingness to learn and your discipline to stay safe in a fast-changing market.

👉 Whether your goal is long-term growth, passive income, or just learning about the future of money—investing in cryptocurrency can be your starting point.