How to Avoid Crypto Scams in 2025: 7 Smart Tips Every Beginner Should Know

How to avoid crypto scams in 2025 is a question every beginner should be asking. As the crypto space continues to grow, so do the risks of falling for fake giveaways, phishing links, and scammy investment schemes. In this blog, you’ll learn 7 smart and simple tips that will help you spot red flags early, protect your digital assets, and build your crypto journey with confidence.

Why Crypto Scams Are on the Rise

The rise of cryptocurrency has opened up new financial opportunities—but it has also opened the door for scammers. Understanding why crypto scams are on the rise helps you stay alert and protect your digital assets.

1. Lack of Regulation

Cryptocurrency is still a new and mostly unregulated market in many countries. This lack of oversight makes it easier for scammers to operate freely, especially on social media platforms and anonymous chat apps.

2. High Public Interest

More people than ever are searching for ways to invest in crypto. Scammers take advantage of beginners who are eager to earn profits but lack technical knowledge. The more people enter the market, the more targets scammers have.

3. Anonymity and Irreversible Transactions

One of crypto’s biggest features—privacy—is also its biggest risk. Scammers can steal money and disappear without a trace, and once you send crypto, the transaction can’t be reversed.

4. Fake Projects and Hype Marketing

Some crypto scams use fake coins or DeFi projects with promises of huge returns. These are pushed using fake reviews, influencer marketing, and social media hype—making it hard to know what’s real.

5. Advanced Scamming Techniques

Today’s scammers use phishing sites, fake apps, and deepfake videos to trick even experienced users. They may impersonate trusted influencers or tech support agents to steal private keys or wallet access.

- After the Introduction paragraph:

➤ Image idea: A warning sign on a phone screen showing a fake crypto transaction. - Under “Lack of Regulation” or “High Public Interest”:

➤ Image idea: Chart showing the increase in crypto adoption alongside scam reports (can be an infographic). - Near the end, after “Advanced Scamming Techniques”:

➤ Image idea: Side-by-side comparison of a real and fake crypto website or app login page.

Most Common Types of Crypto Scams

If you’re planning to invest in digital currencies, it’s crucial to understand the most common types of crypto scams. These scams are designed to steal your money or personal information — often by looking completely legitimate.

Here are the top scams you need to know about in 2025:

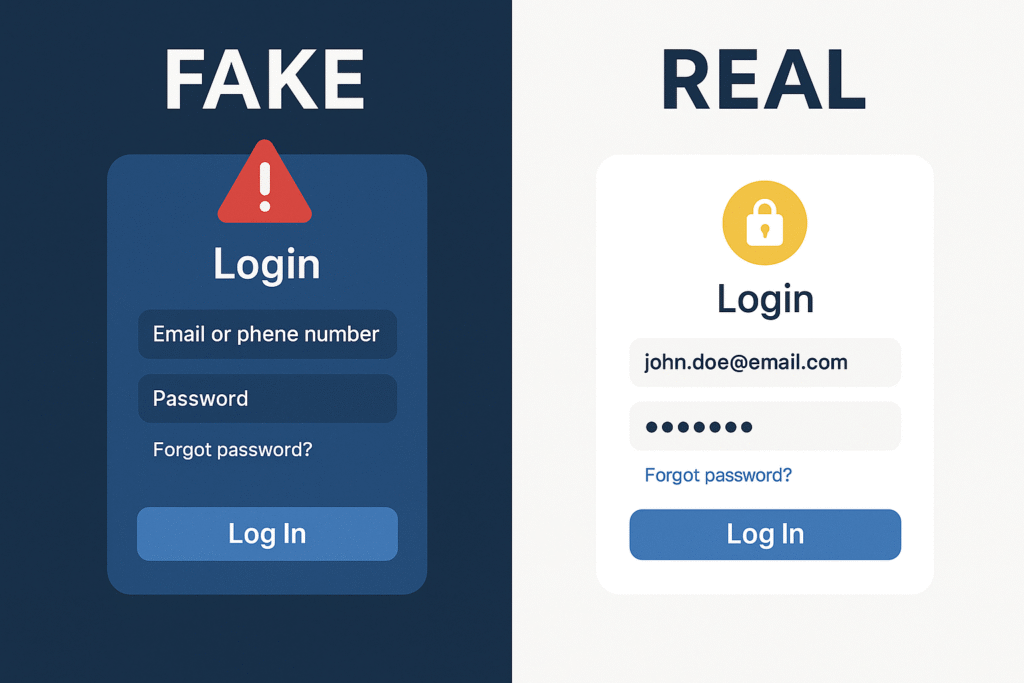

1. Phishing Scams

Phishing is one of the most common crypto scams. Scammers create fake websites or apps that look identical to real ones, then trick you into entering your wallet details or private keys.

How it works:

You receive an email or message claiming to be from your exchange or wallet provider. It contains a link to a fake site that asks you to “log in.” Once you enter your details, the scammers steal your funds.

2. Rug Pulls

A “rug pull” happens when a crypto project gets a lot of attention, collects investor money, then disappears suddenly — taking your funds with it.

How it works:

Developers create a new token and promote it heavily on social media. Once enough people buy in, they sell all their tokens and delete everything.

Example: The Squid Game token scam in 2021.

3. Fake Giveaways

These scams promise to double your crypto if you send them some first — but you never get anything back.

How it works:

Scammers create fake social media accounts pretending to be Elon Musk or other influencers. They say, “Send 0.1 BTC and get 0.2 BTC back.” Many people fall for this trick.

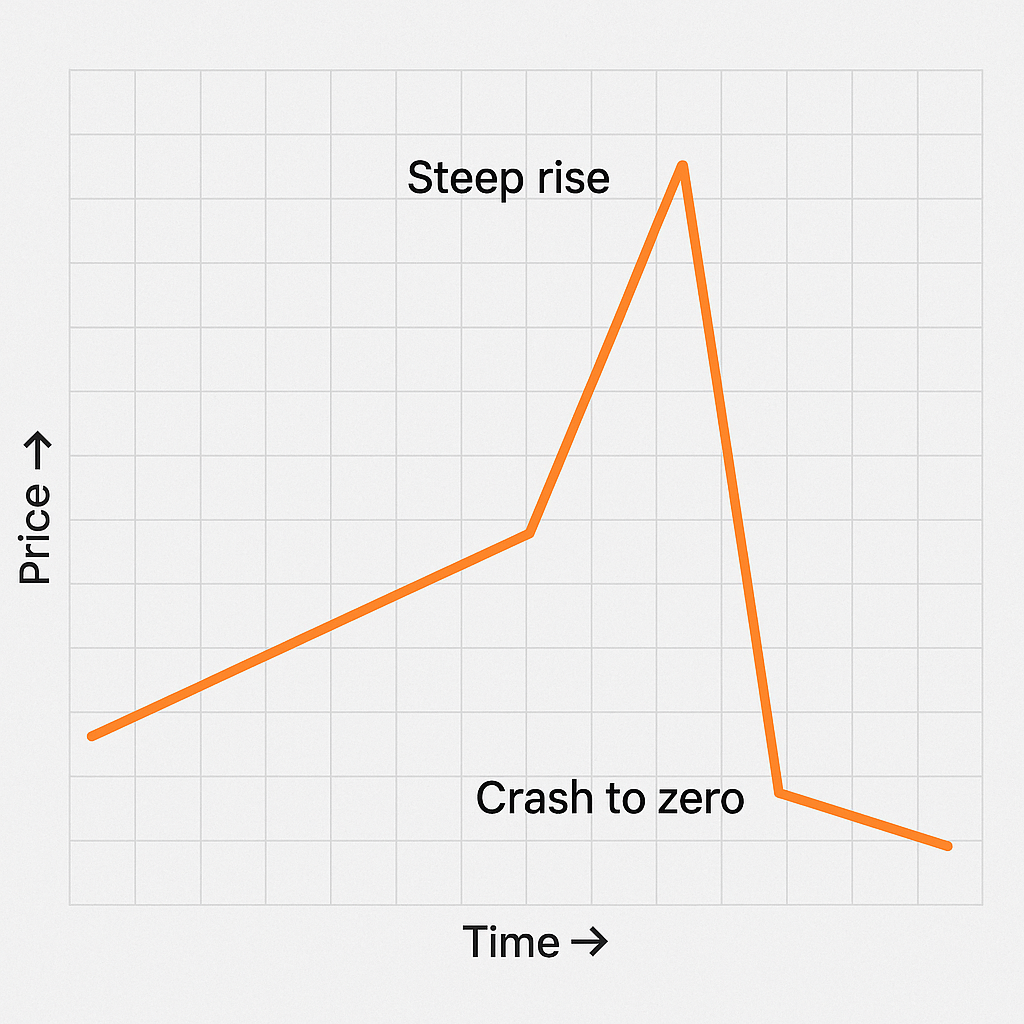

4. Pump-and-Dump Schemes

This scam involves hyping a low-value coin to drive its price up. Once the price spikes, the scammers sell their coins, causing the value to crash.

How it works:

A group secretly buys a coin, promotes it everywhere, and waits for others to invest. Once the price increases, they dump the coin for profit and leave investors with worthless tokens.

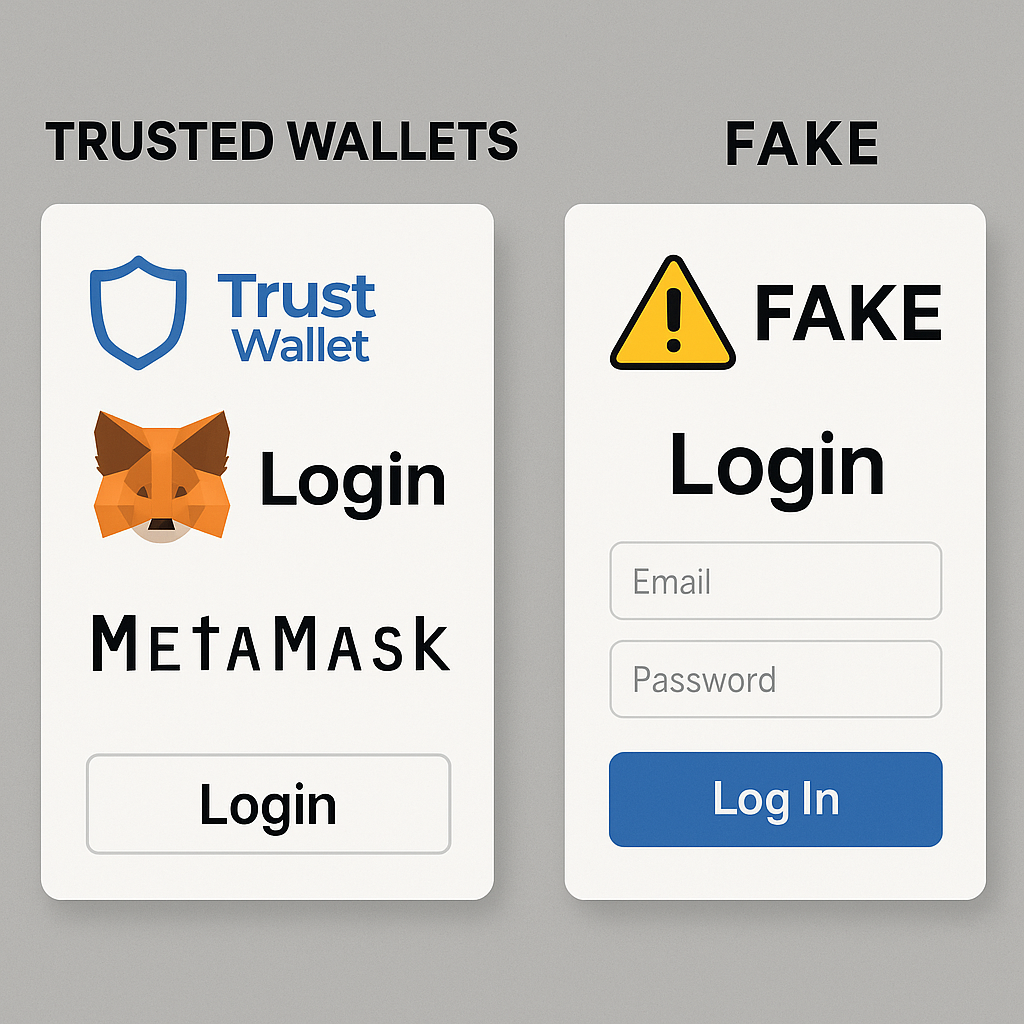

5. Fake Wallets and Apps

Some apps pretend to be secure crypto wallets but are designed to steal your money.

How it works:

You download what looks like a real wallet from a third-party website or app store. When you deposit crypto into it, the developers take your funds and vanish.

Tip: Always download wallets from official websites or app stores.

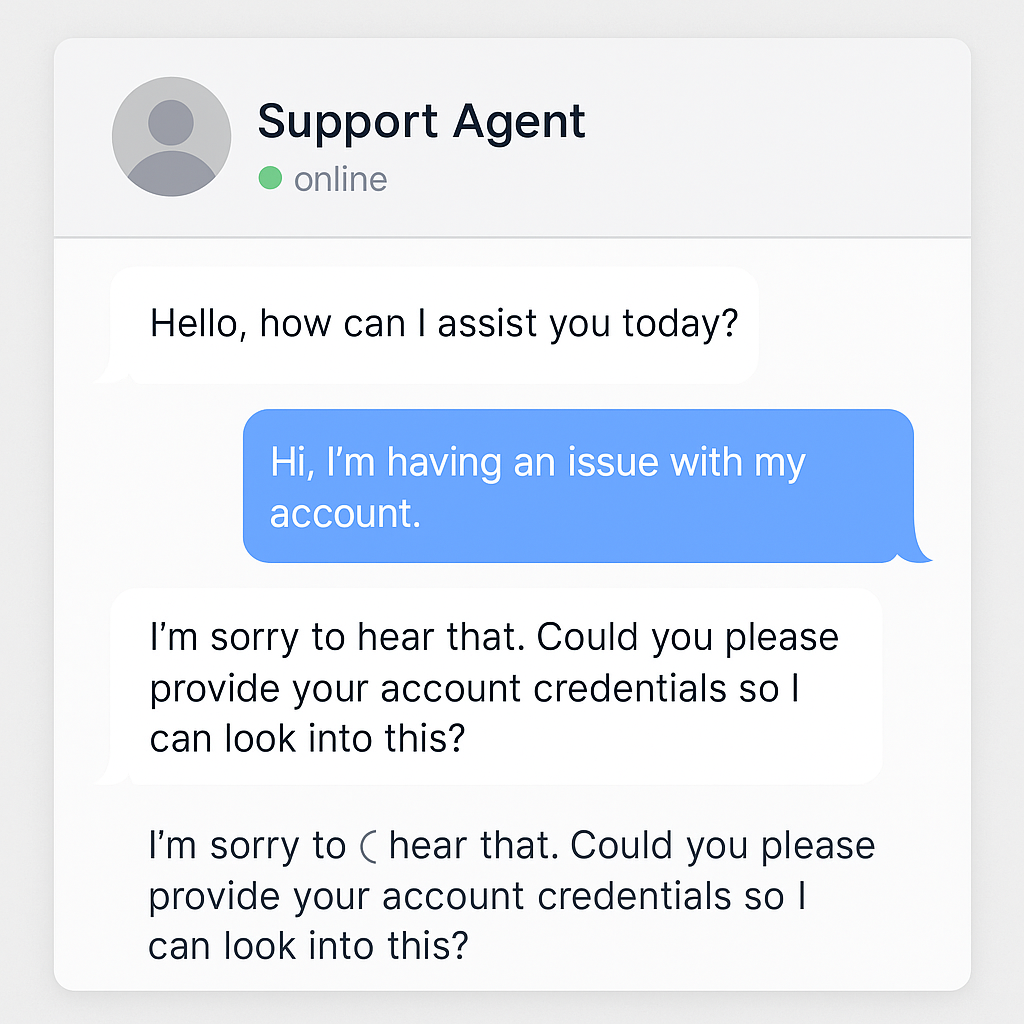

6. Impersonation Scams

Scammers pretend to be someone you trust — like customer support agents or crypto influencers.

How it works:

They message you directly on Telegram, WhatsApp, or Twitter offering help or investment advice. They may ask for your wallet info or try to get access to your account.

Tip: Legit companies will never DM you asking for your private key or seed phrase.

🧠 Final Thought for This Section

These most common types of crypto scams are everywhere online — but knowing how they work gives you power. Always double-check links, avoid sharing sensitive information, and trust your instincts.

How to Avoid Crypto Scams: 7 Essential Tips

Learning how to avoid crypto scams is a must for anyone entering the world of cryptocurrency. Scammers use tricks that are getting harder to spot — but with the right knowledge, you can protect yourself and your investments.

Here are 7 essential tips to keep your crypto safe:

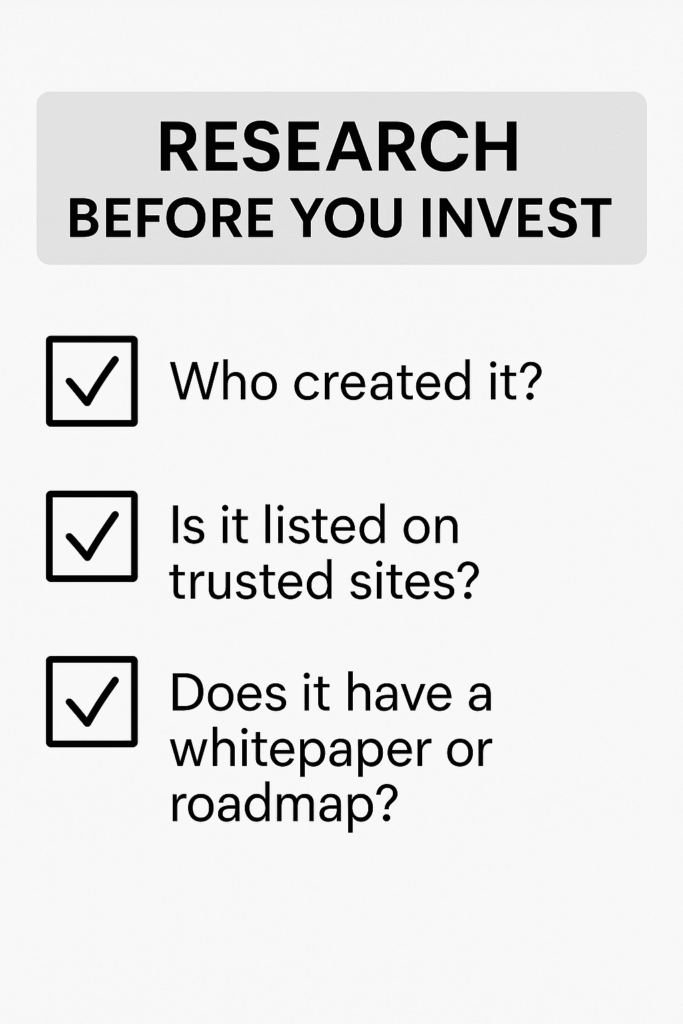

1. Do Thorough Research Before You Invest

Before buying any coin or joining a crypto project, always research:

- Who created it?

- Is it listed on trusted sites like CoinMarketCap or CoinGecko?

- Does it have a whitepaper or roadmap?

👉 If you can’t find solid info, it’s better to walk away.

2. Use Only Trusted Exchanges and Wallets

Stick to known platforms like Coinbase, Binance, or Kraken for buying crypto. For wallets, use apps like MetaMask, Trust Wallet, or Ledger (hardware wallet).

Avoid:

- Links sent through DMs

- Unverified mobile apps

- Exchanges with no public team or address

3. Never Share Your Private Key or Seed Phrase

Your private key or seed phrase is like the password to your crypto wallet.

No real company will ever ask for it.

If someone asks you to share this info “to help recover your account” — it’s a scam.”

4. Turn On Two-Factor Authentication (2FA)

2FA adds an extra layer of protection. Even if someone gets your password, they can’t log in without your second code (usually sent to your phone or app like Google Authenticator).

✅ Always enable 2FA on:

- Wallets

- Exchanges

- Email accounts linked to your crypto

5. Be Wary of “Too Good to Be True” Promises

If someone offers to double your crypto or promises guaranteed profits — that’s a huge red flag.

Crypto is unpredictable. Real investors and platforms will never offer guaranteed returns.

6. Verify Social Media Accounts and Links

Scammers often create fake pages that look like real influencers or companies. Before clicking any link:

- Check for verified badges

- Look at usernames closely (some add extra letters)

- Visit official websites directly instead

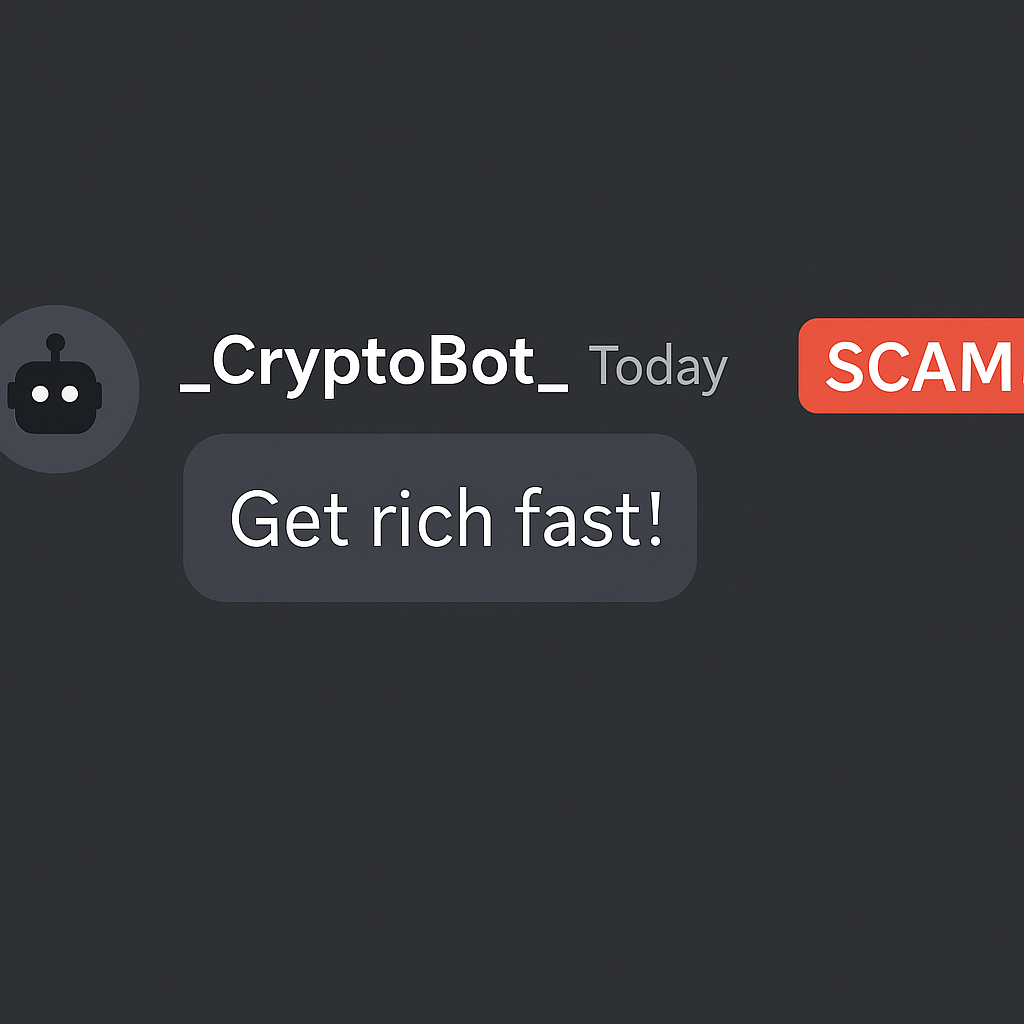

7. Avoid Random DMs or Offers in Chat Groups

Many scams start with a message like “Hey! I can help you invest” or “Join this new token before launch.”

Don’t trust strangers who reach out in Telegram, Discord, or WhatsApp groups.

👉 Rule: If they message you first, it’s probably a scam.

✅ Final Reminder

These 7 tips will help you avoid most crypto scams — but always stay alert. If something feels suspicious, it probably is. Trust your gut, do your research, and protect your keys.

Examples of Real Crypto Scams You Should Know

Understanding real-life crypto scams helps you spot danger before it’s too late. These are not just “theoretical risks”—millions of dollars have been stolen through scams that looked trustworthy at first.

Here are real examples of crypto scams you should know to stay safe in 2025:

1. BitConnect (Ponzi Scheme)

What happened:

BitConnect promised daily returns of up to 1% by investing in its “trading bot.” Thousands of people invested. In 2018, it shut down suddenly—revealed as one of the biggest Ponzi schemes in crypto history.

Why it matters:

It fooled thousands with fake testimonials, YouTube promos, and a professional-looking site.

2. Squid Game Token (Rug Pull)

What happened:

Inspired by the hit Netflix series, the SQUID token launched in 2021. It shot up in price—over 75,000%—then crashed to zero as the developers vanished with millions.

Why it matters:

No official connection to Netflix. Buyers couldn’t even sell the token before the crash.

3. Fake Elon Musk Giveaways (Impersonation Scam)

What happened:

Scammers set up fake Twitter, YouTube, or Telegram accounts pretending to be Elon Musk. They asked people to send small amounts of crypto with a promise to send double back.

Why it matters:

Thousands fell for it, losing BTC and ETH, especially during market hype events.

4. Telegram & WhatsApp Investment Bots (Phishing + Impersonation)

What happened:

Scammers messaged crypto group members offering help, secret investment tips, or recovery tools. Once you click their link or share your wallet, your funds are stolen.

Why it matters:

These scams often use fake admin profiles and stolen logos to gain trust.

5. MetaMask Fake Apps (Fake Wallet Scam)

What happened:

Several users downloaded fake MetaMask apps from unofficial app stores. After entering their seed phrase, their wallets were drained instantly.

Why it matters:

Even trusted brand names can be faked. Always download from official sources only.

✅ Final Reminder for Readers

These real crypto scams you should know prove that being cautious isn’t optional — it’s essential. Learn from others’ mistakes. If something feels off, pause, verify, and protect your crypto.

Final Tips: Stay Smart, Stay Safe

When it comes to navigating the world of cryptocurrency, one rule always applies: stay smart, stay safe. With scams on the rise and technology evolving fast, even experienced users can make costly mistakes. Here are some final essential tips to protect your crypto journey.

1. Always Use the Safest Crypto Wallets

Use trusted and secure wallets — both hot and cold — to store your digital assets. Avoid unknown or newly launched wallets that have no reputation or security history.

2. Double-Check Every Transaction

Crypto transactions are irreversible. Whether you’re sending funds or connecting to a DApp, double-check the address and platform to avoid errors or fraud.

3. Avoid “Too Good to Be True” Offers

Promises of high returns, free giveaways, or instant profits are classic red flags. If it sounds too good to be true, it usually is. Stay alert and skeptical.

4. Keep Your Recovery Phrases Offline

Never store your seed/recovery phrases online or on cloud services. Write them down and store them in a secure place that only you can access.

5. Educate Yourself Regularly

Crypto is changing fast. Read blogs, follow trusted crypto news sources, and join verified communities. Staying updated will help you avoid outdated advice or new threats.

6. Use Two-Factor Authentication (2FA)

Secure your exchange and wallet accounts with 2FA wherever possible. This simple step adds another layer of protection against hackers.

7. Trust Your Instincts

If something feels wrong — stop. Take time to research and confirm before making any decisions. It’s better to be safe than sorry.

Conclusion

As the world of cryptocurrency continues to grow, so do the risks that come with it. Staying informed, cautious, and security-minded is no longer optional — it’s essential. By following the steps shared in this guide, using the safest crypto wallets, and applying basic security practices, you’re protecting not just your digital assets, but your financial future.

Remember: Stay smart, stay safe. Avoid shortcuts, double-check every move, and always put safety first. Crypto success isn’t just about profits — it’s about protecting what you earn.

If you found this guide helpful, share it with others and help build a safer crypto community.