Are Mobile Crypto Wallets Safe For Long-Term Storage? (2025 Review)

Are Mobile Crypto Wallets Safe for Long-Term Storage

Are Mobile Crypto Wallets Safe For Long-Term Storage? (2025 Review) explores the pros, cons, and risks of using mobile wallets to store crypto. Learn about custodial vs non-custodial wallets, essential security features like 2FA and biometrics, and why cold storage may be safer for holding Bitcoin and altcoins in the long term.

Worried about the safety of your crypto assets in a mobile wallet? Many users ask, “Are Mobile Crypto Wallets Safe For Long-term Storage,” as hacks and theft remain real risks. 2 This article will guide you through key features, security tips, and compare hot wallets with cold storage like hardware wallets or paper wallets. 1 Keep reading to learn how to better protect your bitcoin and other digital assets today. 3

Key Takeaways

- Mobile wallets are easy to use but face risks like hacking and malware. Cold storage is safer for long-term.

- Non-custodial wallets give you control of your private keys, offering better security than custodial options.

- Use features like biometric authentication and two-factor authentication (2FA) to protect your mobile wallet.

- Always keep software up to date and back up your seed phrase offline in a safe place.

- Avoid using public Wi-Fi for crypto transactions to reduce the risk of theft.

What Are Mobile Crypto Wallets?

Moving from the basics, mobile crypto wallets act like digital wallets on your smartphone. These apps hold and let you use cryptocurrencies such as Bitcoin or Ethereum. Popular choices include Trust Wallet, MetaMask, Exodus, and Coinbase Wallet.

Most run on Android or iOS devices. 1

Hot wallets work online and are great for quick access to funds; you can trade or send coins with just a few taps. Non-custodial options give you full control over your private keys and seed phrase—no third party involved.

With non-custodial wallets, only you have access to your assets. 1

Mobile crypto wallets help manage everything from tokens to NFTs and even connect to decentralized applications (dApps) in decentralized finance (DeFi). Unlike cold storage solutions like hardware devices or paper wallets that stay offline for security, phones keep these tools at your fingertips but linked to the internet most of the time.

Types of Mobile Crypto Wallets

Mobile crypto wallets come in different forms—each handles your private keys and recovery phrase in its own way. Picking the right app or software can boost your bitcoin security and long-term crypto storage plan.

Custodial Wallets

Custodial wallets, like those managed by Coinbase or Binance, keep your cryptocurrency private keys on their own servers. Third-party companies control these wallets. They offer user-friendly access to crypto-assets and often provide extra features such as insurance against certain types of theft or loss.

Many people use custodial wallets because they make buying, selling, and sending crypto easy for beginners. 2

These wallets pool funds from many users in one place. This pooling creates a big target for cyberattacks and brute-force attacks. Users give up direct control over seed phrases and private keys with custodial wallets—a major difference from non-custodial options like the Ledger Nano X hardware wallet or paper wallets kept in cold storage.

Even though some services claim high-level cybersecurity protections, hackers still target them due to the large pools of funds stored there. If you want quick access to digital assets for trades or spending, a custodial wallet feels convenient; but storing large amounts long-term carries bigger risks compared to keeping coins offline with hardware devices or paper backups. 3

Non-Custodial Wallets

Non-custodial wallets hand control of private keys and digital assets to you, not a third party. 4 Popular mobile options like Coinbase Wallet, MetaMask, Zengo, and Trust Wallet let users manage crypto coins, NFTs, and even support cross-chain transfers.

These cryptocurrency wallets use strong tools such as biometric authentication and encrypted private keys for better security.

“Not your keys… not your coins.”.

If you use a non-custodial wallet app on your phone or tablet for crypto transactions or DeFi activities, always keep track of your seed phrase or recovery phrase. 4 Some wallets add layers of safety with two-factor authentication (2FA) or backup features in case the device is lost.

Staying on top of software updates further protects funds from malware or phishing scams targeting mobile crypto wallets.

Security Features of Mobile Crypto Wallets

Mobile crypto wallets use tools like fingerprint or face unlock, and keep your private keys encrypted inside the device. Modern apps often add two-factor checks—making it harder for attackers to access your digital assets without extra steps.

Biometric Authentication

Biometric authentication uses your fingerprint or face to unlock crypto wallets. Many mobile wallet apps, like Ledger Nano X and Trezor Safe 3, offer this feature. This makes it much harder for hackers to steal your digital assets, even if they get access to your device.

Biometric checks work with other security features such as encrypted private keys and two-factor authentication (2FA) for extra protection. 5

Wallet providers use advanced tools to secure cryptocurrency tokens inside their apps. If someone tries a brute force attack or steals your phone, biometrics keep unauthorized users locked out.

These security layers help protect bitcoins as well as all types of crypto transactions on the app. Always set up biometric authentication where possible in any software wallet you use for storing coins long-term.

Encrypted Private Keys

Encrypted private keys act like secret codes that keep your crypto wallets safe. Mobile wallet apps use strong encryption to lock up these private keys on your device, so only you can unlock them with a PIN, password, or fingerprint.

If someone steals your phone but cannot get past the encryption and authentication features, they will not be able to access your digital assets. 1 Apps like Ledger Nano X and Trezor Safe 3 secure these encrypted keys inside their software using advanced technology.

Private keys never leave the app or move across networks in plain text. This makes it safer for long-term crypto storage since hackers cannot easily decrypt them even if they get hold of raw files from the mobile wallet. 6 Many non-custodial wallets store both public and private keys safely within the app itself while allowing you easy access to send crypto transactions by scanning QR codes or entering passwords.

Strong protection of these encrypted private keys gives you peace of mind when storing bitcoin or other cryptocurrencies in hot wallets on your smartphone.

Two-Factor Authentication (2FA)

Moving from encrypted private keys, another key security layer is two-factor authentication, or 2FA. This method adds more protection to crypto wallets by asking for a second way to prove your identity.

Many mobile crypto wallets now use hardware security modules or one-time passwords (OTP) as part of their daily login and transaction routines. 7

With 2FA in place, hackers need access to both your password and something else that only you have—like an SMS code, trusted device notification, or authentication app such as Google Authenticator.

“Extra steps mean extra safety for long-term storage.” These features help keep digital assets safer from hacking attempts and phishing scams. Using strong passwords with multi-factor authentication on software wallets improves bitcoin security for everyday users who store crypto on their phones. 1

Risks Associated with Mobile Crypto Wallets

Mobile crypto wallets carry real risks, such as hackers targeting your software wallet or bad actors using phishing scams—learn how to protect your Bitcoin and digital assets in the next section.

Susceptibility to Hacking

Hackers target hot wallets on smartphones because they hold private keys and connect to the internet. Chainalysis reported $3.8 billion stolen from crypto users in 2022, which stands as an all-time high for theft. 6 While thefts dropped to $1.7 billion in 2023, hacking attempts actually increased during that year.

Security gaps exist between blockchains and wallet apps that store your recovery phrase or seed phrase. 6 Even strong features like biometric authentication or two-factor authentication (2FA) cannot stop every attack if malware sneaks into your device or operating system.

Attackers use phishing scams, fake QR codes, and even weak app permissions to steal digital assets stored in software wallets, including well-known ones like Ledger Nano X and Trezor Safe 3.

Keeping hardware wallets offline helps protect cryptocurrencies against these risks better than mobile storage does. Stay alert to new crypto threats because blockchain analysts see hackers getting smarter each year.

Device Loss or Theft

Losing your phone or having it stolen can put your mobile crypto wallet at great risk. 8 Many users store private keys and recovery phrases directly on their devices. This makes digital assets much more vulnerable than with cold wallets or hardware wallets like Ledger Nano X or Trezor Safe 3, which use offline storage.

Without strong security—like biometric authentication, two-factor authentication (2FA), and encrypted private keys—your funds may be drained fast if someone gets access to your device.

A missing phone means you could lose all access unless you carefully backed up the seed phrase somewhere safe such as a USB drive or paper wallet not connected to the internet. In 2022 alone, thousands of crypto wallet users reported loss of funds after losing control of their phones because they had no backup plan for recovery phrases or did not secure their devices against theft.

Protecting both your device and seed phrase is vital for long-term storage and cryptocurrency security.

Malware and Phishing Attacks

Malware and phishing attacks target mobile crypto wallets using fake apps, pop-ups, and phishing scams. Hackers often use these tricks to steal private keys or seed phrases. Android devices face higher risks, making up 40% of all security breaches in mobile crypto wallets. 9 Attackers may also exploit loopholes in internet protocols used by crypto wallet apps.

Installing suspicious software or clicking on bad links can let malware into your device. Phishing sites may trick users into entering recovery phrases or backup details. Always be careful with QR codes and contactless features; hackers sometimes use them for silent data theft during crypto transactions.

Using strong two-factor authentication (2FA) adds another layer against unauthorized access to digital assets stored in hot wallets or cloud services.

Best Practices for Using Mobile Crypto Wallets Safely

Make sure your device stays up to date and free of malware, since even strong crypto wallets like Ledger Nano X or Trezor Safe 3 rely on safe operating systems. Always secure your seed phrase—writing it on paper and keeping it offline can be the difference between losing access and quick recovery.

Regular Software Updates

Keeping your crypto wallet app updated prevents hackers from finding and using loopholes. Wallets like Ledger Nano X or Trezor Safe 3 rely on regular software and firmware updates to patch new threats, fix bugs, and block malware.

Researchers found that out-of-date apps are often the first targets of phishing scams. 9 Attackers use these soft spots to steal private keys or seed phrases.

Set your device’s operating system to auto-update whenever possible. Check for updates after any news about security flaws in popular wallets like Ledger Flex or other hot wallets.

Staying current with crypto wallet software helps protect digital assets against crypto mining malware and keeps backup and recovery features working right. Next, learn how backing up seed phrases secures access even if you lose your phone.

Backing Up Seed Phrases

After updating your wallet app, move to the next crucial step—backing up seed phrases. A seed phrase is a set of words that lets you recover your crypto wallets and private keys if you lose access to your device.

Write down this recovery phrase on paper, not on any digital device or cloud service, to avoid hacking risks. Even advanced phones like one with a secure element chip cannot fully protect digital copies from online threats. 8

Store that piece of paper in a high-security place—a locked safe box, hidden drawer, or even an offline storage device that never touches the internet. Many experts suggest making more than one copy but keeping each in separate secret places.

Do not take pictures or save QR codes containing these keywords anywhere digital; hackers target such images during phishing scams and malware attacks. Hardware wallets like Ledger Nano X and Trezor Safe 3 also use seed phrases for backup; treat those just as carefully. 10 Taking these steps protects your bitcoin security and all other crypto assets for long-term storage—even if your phone gets lost, stolen, or fails due to technical errors.

Avoiding Public Wi-Fi for Transactions

Public Wi-Fi makes your crypto wallet an easy target. Hackers can use weak encryption and lack of device isolation to steal your private keys or recovery phrase during transactions.

On public networks, risks like Man-in-the-Middle attacks, session hijacking, or credential theft are much higher. 11

Stay safe by doing all crypto transactions only on trusted and private internet connections. This cuts the chance of a hacker getting hold of your bitcoin security details or seed phrases.

For critical actions like transferring digital assets between hot wallets and cold storage devices such as Ledger Nano X or Trezor Safe 3, wait until you’re back on a secure network at home—or use mobile data instead of shared Wi-Fi for sensitive crypto activity.

Are Mobile Wallets Suitable for Long-Term Storage?

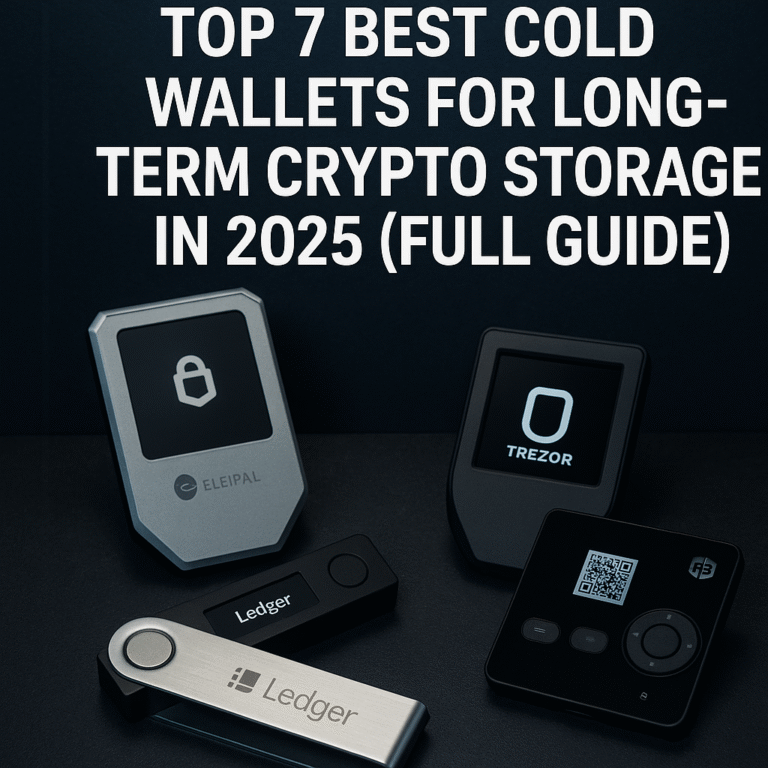

Cold storage stays the safest method for long-term crypto storage. Devices like Ledger Nano X, Trezor Safe 3, or even using paper wallets keep private keys offline. Mobile wallets fall into the hot wallet category since they stay connected to the internet.

Hackers target software wallets and mobile apps more often than cold wallets. 7

About 17 percent of Bitcoin is lost forever due to misplaced recovery phrases or private keys. Holding large amounts in a mobile wallet puts your digital assets at risk if you lose your device, get malware, or face phishing scams.

Mobile wallets are great for quick crypto transactions using QR codes, seed phrases, and biometric authentication such as fingerprints or facial recognition. Still, use them only for small amounts that you plan to spend soon rather than for long-term storage of bitcoin or other cryptocurrencies.

For security on big investments over time, stick with hardware wallet devices and cold storage methods instead of relying on software-based solutions like custodial or non-custodial mobile apps.

Conclusion

Mobile crypto wallets work well for quick access and daily use. For long-term storage, experts suggest hardware wallets like Ledger Nano X or Trezor Safe 3. These cold wallet options keep your private keys away from the internet, cutting hacker risk.

If you want strong bitcoin security over time, move digital assets to offline storage such as a thumb drive or paper wallet. Protect your seed phrase and update firmware often for safer cryptocurrency and security peace of mind.

FAQs

1. What makes mobile crypto wallets safe for long-term storage?

Mobile crypto wallets offer several security features that make them suitable for long-term storage of digital assets. These include private keys, recovery phrases or seed phrases, and two-factor authentication (2FA). Some even have biometric authentication to add an extra layer of protection.

2. How do hardware wallets like Ledger Nano X and Trezor Safe 3 compare to software wallets for cryptocurrency security?

Hardware wallets like Ledger Nano X and Trezor Safe 3 are considered safer than software wallets as they provide offline storage or cold storage options. They store your private keys on a secure element chip, reducing the risk from online threats such as phishing scams.

3. Are there any risks involved with using QR codes in crypto transactions?

While QR codes can simplify crypto transactions by eliminating the need to manually enter complex public key information, they may expose users to some risks if not handled properly. For instance, malicious actors could replace legitimate QR codes with fraudulent ones leading to loss of funds.

4. Can I use both hot and cold wallet methods for long-term crypto storage?

Yes! Combining hot wallets (online) and cold wallets (offline) provides a balance between convenience and security for managing cryptocurrencies over the long term. You can keep a small amount in your hot wallet for daily transactions while storing larger amounts in a more secure offline environment provided by paper or hardware wallet options.

5. How does firmware updates affect my mobile crypto wallet’s safety?

Firmware updates often contain important patches that fix vulnerabilities within the system enhancing your cryptocurrency’s security level—so it’s crucial you keep up-to-date!

6.What is the difference between custodial and non-custodial mobile crypto-wallets when considering long-term storage?

Custodial mobile crypto-wallets involve third-party control over your private keys while non-custodial ones give you full control over your own keys. For long-term storage, non-custodial wallets are generally recommended as they give you full control over your digital assets and reduce the risk of third-party breaches.

References

- ^ https://money.com/best-crypto-wallets/ (2025-05-30)

- ^ https://www.mdpi.com/1999-5903/17/1/7

- ^ https://academic.oup.com/jfr/article/11/1/73/8102896

- ^ https://coinbureau.com/analysis/best-crypto-wallets/

- ^ https://coinbureau.com/analysis/best-android-crypto-wallets/

- ^ https://www.researchgate.net/publication/389965491_Security_Vulnerabilities_of_Cryptocurrency_Wallets_-A_Systematic_Review (2025-03-21)

- ^ https://dl.acm.org/doi/full/10.1145/3596906

- ^ https://coinledger.io/tools/best-cold-storage-wallets

- ^ https://www.cureusjournals.com/articles/1099-detailed-review-on-enabling-secure-and-seamless-crypto-wallet-a-blockchain-solution.pdf

- ^ https://www.security.org/digital-security/crypto/

- ^ https://securitysenses.com/posts/risks-using-public-wi-fi-crypto-transactions (2025-05-13)