Cold Wallet vs Hot Wallet Security Explained (2025 Guide for Crypto Users)

Confused about crypto storage? This 2025 guide explains cold wallet vs hot wallet security in simple terms. Learn which one is safer and best for your needs.

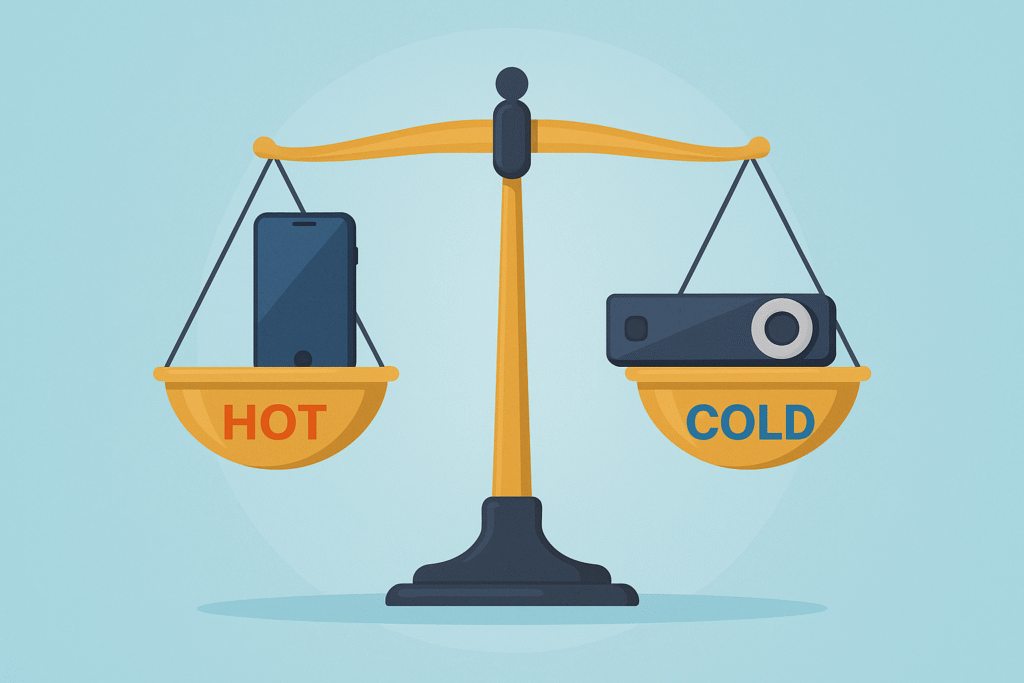

cold wallet vs hot wallet security explained

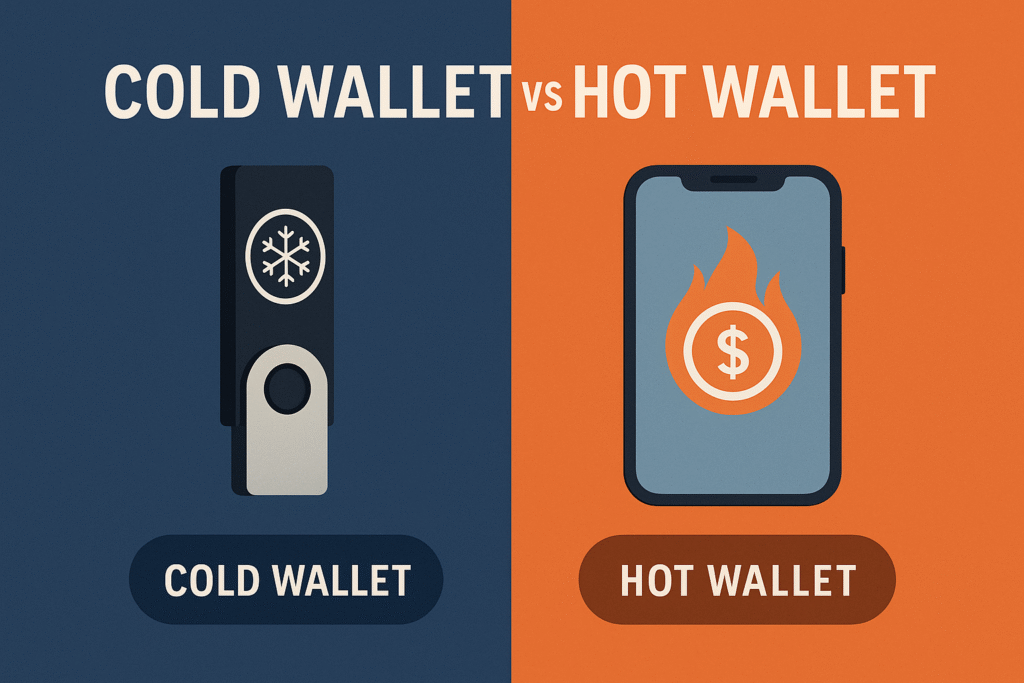

As more people invest in crypto in 2025, one question keeps coming up: how do you safely store your digital assets? Choosing the right type of wallet is crucial—and that’s where this cold wallet vs hot wallet security explained guide comes in.

In this post, you’ll learn the key differences between cold wallets (offline storage) and hot wallets (online access), along with which one offers better protection against hackers, scams, and human errors.

Purpose: Helps users immediately understand the comparison visually before reading.

Whether you’re a complete beginner or a growing investor, understanding how each wallet type works will help you:

- Keep your crypto safe

- Avoid major losses from hacks

- Make smart long-term decisions

This 2025 guide gives you a simple, clear comparison of cold wallet vs hot wallet security, including pros, cons, and tips to protect your funds.

What Is a Hot Wallet?

A hot wallet is a type of cryptocurrency wallet that stays connected to the internet. This constant connection makes it easy to access your crypto anytime, making hot wallets ideal for daily transactions and trading.

Hot wallets are popular because they’re:

- Easy to use

- Free or low-cost

- Accessible through mobile apps, desktops, or web browsers

Common types of hot wallets include:

- Mobile wallets like Trust Wallet

- Browser extensions like MetaMask

- Web wallets on exchanges like Binance or Coinbase

However, when comparing cold wallet vs hot wallet security explained, hot wallets are more vulnerable to online threats such as:

- Phishing attacks

- Malware and viruses

- SIM swap and hacking attempts

Because they’re always online, hot wallets are convenient but carry higher risk—especially if you’re storing large amounts of crypto

Purpose: Helps readers quickly visualize what a hot wallet looks like and connects the concept to real tools they may recognize.

What Is a Cold Wallet?

A cold wallet is a type of cryptocurrency wallet that stores your assets offline. Unlike hot wallets, cold wallets are not connected to the internet, making them much safer from online threats like hacking, malware, or phishing attacks.

Cold wallets are ideal for long-term storage of large amounts of cryptocurrency. Since they are offline, they act like a vault—your crypto is only accessible if you physically connect the wallet to a device.

Common cold wallets include:

- Hardware wallets (e.g., Ledger Nano X, Trezor Model T)

- Paper wallets (printed QR codes or keys)

- Air-gapped devices (completely isolated from any network)

When comparing cold wallet vs hot wallet security explained, cold wallets offer superior protection because:

- Hackers can’t access them remotely.

- Your private keys stay offline.

- You control the device, not a third party.

- Purpose: Gives readers a visual understanding of what a cold wallet physically looks like and emphasizes offline protection.

While they may be less convenient for quick transactions, cold wallets are the best option for securing long-term crypto holdings.

Cold Wallet vs Hot Wallet Security: Key Differences

When deciding how to store your cryptocurrency, it’s important to understand the core differences between cold wallets and hot wallets. This section of our cold wallet vs hot wallet security explained guide breaks down the most important security aspects you need to consider.

Here’s a simple comparison to help you decide:

| Feature | Hot Wallet | Cold Wallet |

|---|---|---|

| Internet Access | Always connected (online) | Offline (no internet connection) |

| Security Risk | Higher risk of hacks and malware | Extremely low risk (offline protection) |

| Best Use Case | Daily trading, quick transfers | Long-term storage, large funds |

| Access Speed | Instant access to funds | Slower – requires manual connection |

| User Experience | Easy for beginners | May need basic tech understanding |

| Cost | Usually free or low cost | Hardware wallets cost money (e.g., $50–$150) |

Summary:

- Hot wallets are fast and convenient but vulnerable.

- Cold wallets are more secure but slower to access.

Understanding these differences will help you store your crypto more wisely based on your goals—whether it’s regular trading or safe long-term storage.

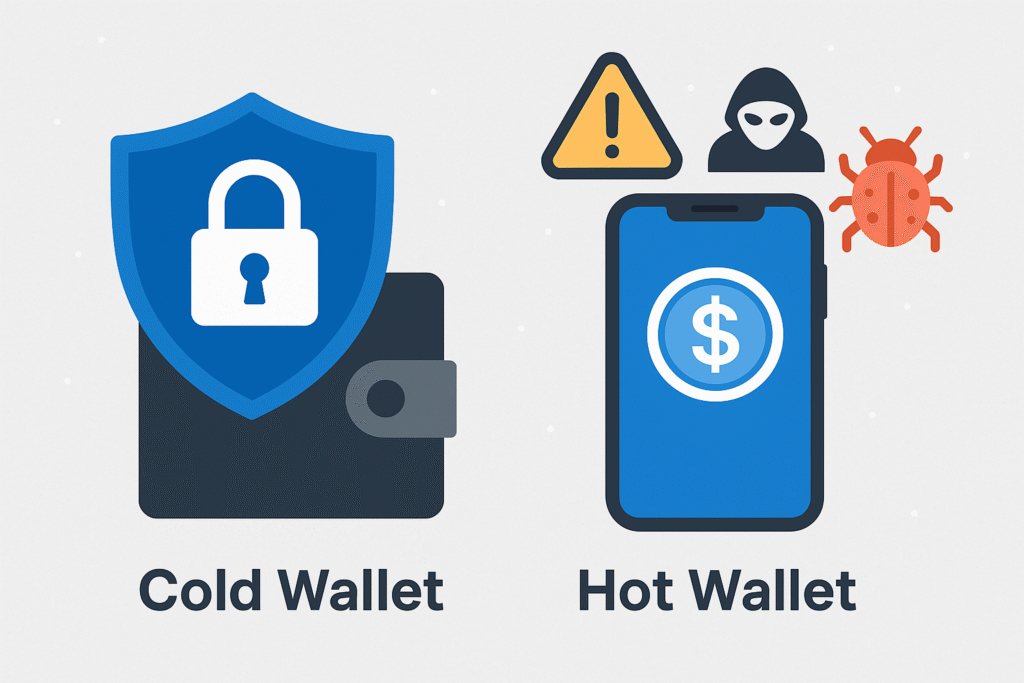

Which One Is Safer?

When it comes to securing your cryptocurrency, the most important factor is how exposed your wallet is to online threats. In this cold wallet vs hot wallet security explained comparison, cold wallets clearly offer better protection.

Here’s why cold wallets are safer:

- They are completely offline, meaning hackers cannot access them through the internet.

- Your private keys never touch a server or browser.

- Attacks like phishing, malware, or exchange breaches don’t affect cold wallets.

Hot wallets, while convenient, are constantly connected to the internet. This makes them more vulnerable to:

- Exchange hacks

- SIM swap attacks

- Phishing links and fake wallet apps

- Device malware or spyware

💡 Pro Tip: If you hold a large amount of crypto, use a cold wallet. If you’re making small daily trades, a hot wallet is fine—but never keep all your funds there.

Purpose: Emphasizes the security strength of cold wallets vs the risks of hot wallets in a visual format.

In short:

- Cold wallet = maximum security

- Hot wallet = convenience with more risk

Choose based on your crypto goals and how often you access your funds.

Pros and Cons

Understanding the pros and cons of each wallet type is essential in this cold wallet vs hot wallet security explained comparison. Below is a breakdown to help you choose the right wallet based on your needs.

🔥 Hot Wallet: Pros and Cons

Pros:

- Fast access to funds

- Easy to use for beginners

- Great for daily transactions and trading

- Usually free or low-cost

Cons:

- Always online (exposed to hacking)

- Risk of phishing, malware, or SIM swap attacks

- Dependent on device and internet security

- Not ideal for storing large amounts

🧊 Cold Wallet: Pros and Cons

Pros:

- Maximum security (offline storage)

- Immune to online hacks and malware

- Ideal for long-term storage

- Full control of your private keys

Cons:

- Slower access to funds

- Hardware wallets can be expensive

- Setup may confuse beginners

- Risk of physical loss if not backed up

Conclusion: Which One Should You Use?

Now that you’ve seen cold wallet vs hot wallet security explained, here’s the bottom line:

- Use a hot wallet if you:

- Make frequent trades

- Only store small amounts of crypto

- Prefer quick and easy access on your phone or browser

- Use a cold wallet if you:

- Hold large amounts of crypto

- Care more about security than speed

- Want to store your assets for months or years

🔑 Best practice: Combine both. Keep your spending funds in a hot wallet and your savings in a cold wallet. This gives you convenience and protection at the same time.

Purpose: Helps users visually understand the smart strategy of using both wallets together.

FAQs

Below are some common questions related to cold wallet vs hot wallet security explained, especially for crypto beginners:

❓Q1: Can I lose my cold wallet?

Yes, if you lose the physical device and didn’t back up your recovery seed phrase, you could lose access to your funds forever.

🔑 Always store your recovery phrase in a safe place.

❓Q2: Is MetaMask a cold wallet?

No, MetaMask is a hot wallet. It runs as a browser extension or mobile app and is always connected to the internet.

❓Q3: Are cold wallets 100% safe?

Cold wallets are extremely secure, but not 100% foolproof. If someone physically steals your device and your backup keys, your funds are at risk.

💡 Always combine cold storage with good physical security habits.

❓Q4: Can I use both a hot and cold wallet?

Yes, this is the best strategy for most users. Use:

- A hot wallet for daily use and small transactions.

- A cold wallet for long-term and large-value storage.

❓Q5: What’s the best cold wallet in 2025?

Popular and trusted options include:

- Ledger Nano X

- Trezor Model T

Choose one based on security features, ease of use, and

- Purpose: Visually highlights the section as helpful, user-focused content.

Choosing between a cold wallet and a hot wallet depends on how you use your cryptocurrency. If you’re actively trading and need fast access, a hot wallet offers convenience—but comes with higher risk. If you’re planning to store large amounts of crypto for the long term, a cold wallet is your safest option.

In this cold wallet vs hot wallet security explained guide, we’ve broken down the differences, pros, cons, and real-life use cases. To protect your crypto in 2025, the smart strategy is to use both wallets together:

- Keep small amounts in a hot wallet for spending or trading.

- Store the majority in a cold wallet for maximum security.

🔐 Security Tip: No matter which wallet you use, always back up your recovery phrase and enable 2FA wherever possible.

With this knowledge, you’re now better equipped to make informed and secure choices for managing your crypto assets.