How to Start Investing with $50 in 2025 – Smart Beginner Guide

How to Start Investing with $50 in 2025: Smart Ways to Grow Your Money

Many people think you need thousands of dollars to start investing. That’s no longer true. In 2025, you can invest with 50 dollars and still build real wealth over time. Thanks to new technology and micro-investing platforms, beginners now have more opportunities than ever to grow their money from a small start.

Even if you’re a student, teen, or someone on a tight budget, $50 is enough to begin your journey into the world of investing. The most important part isn’t how much you start with—it’s that you start now and stay consistent.

With just $50, you can:

- Buy fractional shares of stocks like Apple or Tesla

- Invest in ETFs or index funds for long-term growth

- Try beginner crypto investments safely

- Let a robo-advisor manage your money automatically

- A $50 bill on a desk next to a notebook and calculator

This visual will support the idea of starting small and thinking smart.

Can You Really Invest with $50 in 2025?

Yes, you absolutely can invest with 50 dollars in 2025—and it’s easier than ever. Thanks to modern technology, new investing apps, and low-fee platforms, even a small amount like $50 can open the door to real wealth-building opportunities.

In the past, you needed hundreds or thousands to start investing. But now, companies let you buy fractional shares of big-name stocks, automatically invest in diversified portfolios, or even put small amounts into cryptocurrency—all with just a few taps on your phone.

Many platforms don’t require a minimum balance. That means your $50 is enough to:

- Buy a portion of Amazon or Apple stock

- Start a diversified ETF portfolio

- Begin saving for retirement with a robo-advisor

- Get into crypto with secure wallets and regulated exchanges

💬 The key isn’t how much you start with—it’s consistency, smart choices, and starting early.

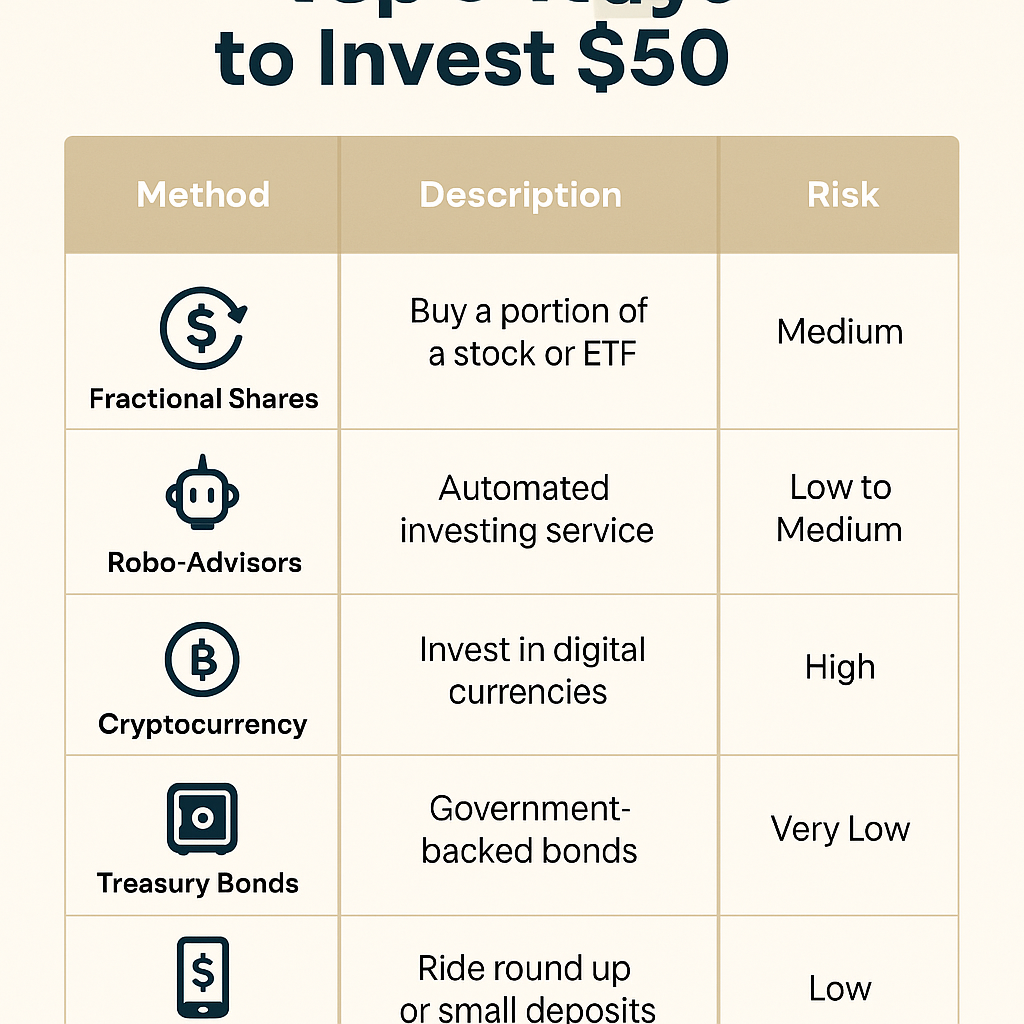

Best Ways to Invest $50 in 2025

If you’re wondering how to invest with 50 dollars in 2025, the good news is—you have plenty of smart, beginner-friendly options. Whether you’re interested in stocks, crypto, or automated platforms, there’s a way to make that $50 grow.

Below are the top ways to get started with your small investment:

1. Buy Fractional Shares of Stocks or ETFs

- What it means: You don’t need to buy a full share. You can own part of Amazon, Tesla, or Google.

- Where: Robinhood, Fidelity, Public

- Why it works: Low entry cost and long-term growth potential

- Risk: Medium

2. Use a Robo-Advisor

- What it is: Automated investing based on your goals and risk level

- Best for: People who don’t want to pick stocks

- Where: Betterment, SoFi, Acorns

- Minimum to start: Often $5 or $50

- Risk: Low to Medium

3. Try Cryptocurrency (Safely)

- Start small: Use $10–$20 to buy top coins like Bitcoin or Ethereum

- Where: Coinbase, Kraken, Binance

- Tip: Store your crypto in a secure wallet like MetaMask or Ledger

- Risk: High, but potential rewards are strong

4. Invest in Treasury Bonds or I Bonds

- Best for: Safe, low-risk income over time

- Where: TreasuryDirect.gov

- Why: Government-backed with stable interest

- Risk: Very Low

5. Join a Micro-Investing App

- Examples: Stash, Acorns, Cash App

- How it works: Round-up spare change or set auto-deposits

- Why it’s good: Passive and beginner-friendly

- Risk: Low

6. Start a High-Yield Savings Account or CD

- Why: Safe place to store $50 while earning small interest

- Where: Ally Bank, Discover, or Capital One

- Best for: Those saving for short-term needs

- Risk: None

💡 The key is not choosing the “perfect” option—it’s picking one and getting started consistently.

How to Choose the Right Investment for You

Choosing how to invest with 50 dollars depends on your personal goals, risk tolerance, and how involved you want to be. Not all investments are the same—some are safer but slower, while others are riskier with the potential for faster returns.

Here are simple steps to help you decide:

1. Know Your Goal

Ask yourself:

- Do I want short-term gains or long-term growth?

- Am I saving for school, a gadget, or future wealth?

If your goal is long-term, investing in ETFs or stocks is a great option. If it’s short-term, consider savings accounts or bonds.

2. Understand Your Risk Tolerance

- Low Risk: Treasury bonds, high-yield savings, robo-advisors

- Medium Risk: Fractional shares, ETFs

- High Risk: Crypto, individual stocks

If you’re unsure, start with low-risk options and grow as you learn.

3. Decide How Hands-On You Want to Be

- If you prefer automatic investing, go with robo-advisors.

- If you like control, choose apps that let you pick your own stocks or crypto.

4. Diversify When Possible

Even with $50, try to spread your money across different assets. For example:

- $25 in ETFs

- $15 in crypto

- $10 in a high-yield savings account

This reduces the risk of losing everything if one investment goes down.

🎯 Start small, stay consistent, and grow your knowledge over time. There’s no “perfect” investment—just the one that fits you best.

Tools You Need to Invest with 50 Dollars

To successfully invest with 50 dollars, you need more than just money—you need the right tools. In 2025, there are many free or low-cost apps and platforms that make investing easy, secure, and beginner-friendly.

Here are the must-have tools to get started:

1. Investment App

You need a reliable app to buy fractional shares, ETFs, or crypto.

Top options:

- Robinhood – Great for stocks and ETFs

- Public – Transparent investing with social features

- Coinbase – Trusted for beginner crypto investing

2. Secure Wallet (For Crypto Users)

If you’re investing in crypto, never store all your funds on exchanges. Use a secure wallet to protect your assets.

Best wallets:

- MetaMask – For Ethereum and tokens

- Ledger Nano S – Hardware wallet for high security

- Trust Wallet – Easy to use and mobile-friendly

3. Robo-Advisor Platform

Don’t want to pick stocks? A robo-advisor invests your $50 automatically based on your goals.

Popular choices:

- Acorns – Invests your spare change

- Betterment – Offers automated portfolios

- SoFi Invest – Includes free tools and learning content

4. Budgeting App

To grow your money, you must track how you save and spend.

Top picks:

- YNAB (You Need a Budget) – Best for serious planners

- Mint – Free and easy to use

- Goodbudget – Envelope-style budgeting

5. Learning Resource

Knowledge is your most powerful tool. Learn the basics of investing so you make smart choices.

Where to learn:

- Investopedia – Free, detailed guides

- Binance Academy – Great for crypto basics

- YouTube – Watch beginner-friendly tutorials

🔍 With these tools, your $50 becomes more than a number—it becomes a launchpad for your future wealth.

Tips to Grow Your Investment Over Time

Once you invest with 50 dollars, the next step is to make your money grow. Smart investing isn’t about quick wins—it’s about patience, consistency, and good habits. Even a small amount can turn into a big return if you use the right strategies.

Here are simple, effective tips to grow your investment over time:

1. Invest Regularly

Make investing a habit. Add $10, $20, or even $5 each month. This is called dollar-cost averaging, and it helps smooth out market ups and downs.

2. Reinvest Your Earnings

If your investment earns dividends, interest, or profits—put it back in. Reinvesting helps your money grow faster through compound growth.

3. Diversify Your Portfolio

Don’t put all your money in one place. Spread it across stocks, ETFs, crypto, or bonds to reduce risk. Even with $50, you can split your investment between different assets.

4. Think Long-Term

Don’t panic when the market drops. Stay focused on long-term goals. Most successful investors grow wealth by holding quality assets over years, not days.

5. Keep Learning

The more you know, the better your decisions. Follow reliable finance blogs, YouTube channels, and apps that offer investing tips.

⏳ Success comes from staying consistent—not from timing the market.

Mistakes to Avoid

When you invest with 50 dollars, it’s important to protect your money by avoiding common beginner mistakes. Even small investments can suffer losses if you rush in without a plan.

Here are the top mistakes to watch out for—and how to avoid them:

1. Chasing Quick Profits

Avoid risky “get-rich-quick” schemes, meme stocks, or unknown crypto tokens promising huge returns overnight. Most of these are hype-driven and can crash fast.

Tip: Stick with reliable assets like ETFs, blue-chip stocks, or top cryptocurrencies (Bitcoin, Ethereum).

2. Ignoring Fees

Some apps charge hidden transaction or withdrawal fees that can eat into your $50 quickly.

Tip: Choose platforms with low or zero fees like Public, Robinhood, or Acorns.

3. Putting All Your Money in One Investment

Don’t bet your entire $50 on a single stock or coin. If it fails, you lose everything.

Tip: Diversify—spread your money across 2 or 3 types of assets.

4. Skipping Research

Investing blindly is a recipe for regret. Always understand what you’re investing in.

Tip: Read basic guides, use learning platforms like Investopedia or Binance Academy.

5. Letting Fear or Hype Control You

Buying out of hype or selling out of fear leads to bad timing. This is how many people lose money.

Tip: Stick to your plan. Trust the long-term process.

⚠️ Even with $50, smart decisions matter. Avoiding mistakes can be just as powerful as choosing the right investment.

Conclusion

Starting your journey to financial freedom doesn’t require thousands of dollars. In fact, you can invest with 50 dollars and still build real wealth over time. The key is to start smart, stay consistent, and use the right tools.

In this guide, you’ve learned:

- That yes—you can invest with just $50 in 2025

- The best beginner-friendly options to grow that money

- How to choose what fits your goals and risk level

- Tools to support your investing journey

- Proven tips to grow your investment—and mistakes to avoid

Remember, it’s not about how much you start with. It’s about getting started, making wise decisions, and letting time do the heavy lifting.

💬 Start today, stay patient, and watch your money grow. Your future self will thank you.