7 Simple Strategies to Avoid Losses in Trading (2025 Beginner’s Guide)

Discover 7 Simple Strategies to Avoid Losses in Trading (2025 Beginner’s Guide) and protect your money with smart risk management, emotional control, and practical trading plans. Perfect for beginners who want to trade safely and avoid common mistakes.

1. Always Use a Trading Plan

One of the simple strategies to avoid losses in trading is to always trade with a clear plan. A trading plan guides your actions and helps you make smart decisions instead of emotional ones. Without a plan, many beginners enter the market blindly and suffer avoidable losses.

A good trading plan should include:

- Your entry and exit points: When will you buy or sell?

- Risk-reward ratio: How much are you willing to risk to reach your profit target?

- Stop-loss and take-profit levels: These automatically close your trade to limit losses or secure profits.

- Market conditions: What signals or patterns will you look for before entering a trade?

2. Control Your Emotions While Trading

Controlling your emotions is one of the simple strategies to avoid losses in trading. Emotional trading often leads to poor decisions, such as entering a trade too early, exiting too late, or risking too much after a loss. Fear and greed are the two biggest reasons why traders lose money.

Successful traders stay calm whether they win or lose. They follow their trading plan without letting feelings influence their decisions. When you feel emotional, it’s best to step away from the screen, take a break, or avoid making new trades until you are clear-headed.

3. Never Risk More Than You Can Afford to Lose

One of the simple strategies to avoid losses in trading is to only risk what you can afford to lose. Many beginners lose large amounts of money because they trade with money meant for important expenses like rent, food, or bills. This creates stress and leads to emotional decisions.

Professional traders recommend risking only 1–2% of your total trading capital on a single trade. This means that even if a trade goes wrong, your overall account balance will remain safe and you’ll have enough funds to trade another day.

If you risk too much, one bad trade could wipe out your account. But when you limit your risk, you can survive losing trades and keep trading long-term. Smart traders think about risk first, profits second.

4. Use Stop-Loss Orders Correctly

One of the most simple strategies to avoid losses in trading is using stop-loss orders the right way. A stop-loss automatically closes your trade when the price hits a certain level, protecting you from bigger losses if the market moves against you.

Many beginners either don’t use stop-losses or place them too far from their entry point. This can cause them to lose more money than planned. Your stop-loss should be set based on your trading plan, not emotions.

✔️ Tips for Using Stop-Loss Orders Correctly:

- Place your stop-loss below a key support level for buy trades.

- Place it above a resistance level for sell trades.

- Avoid moving your stop-loss further away to “give the market more room.” Stick to your plan.

- Always calculate your risk before setting your stop-loss.

5. Learn From Your Past Mistakes

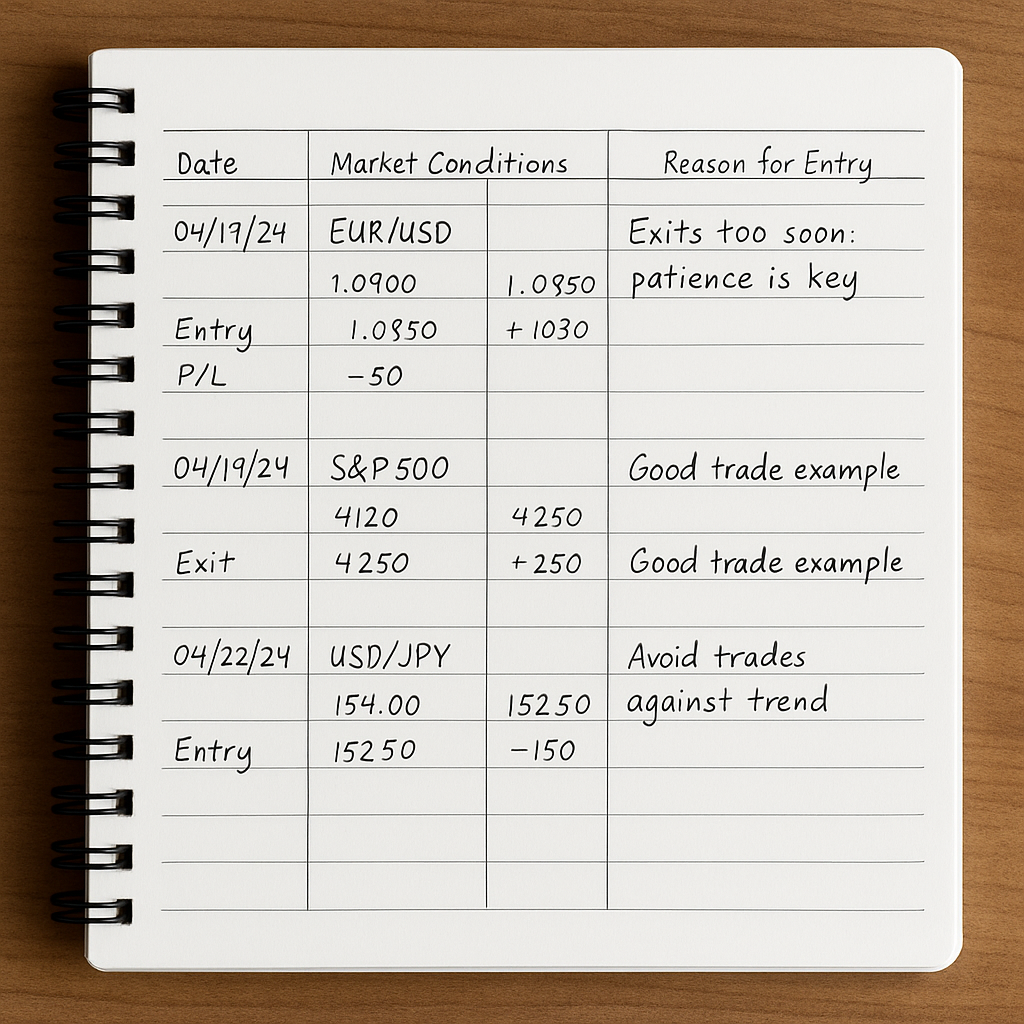

One of the most overlooked simple strategies to avoid losses in trading is learning from your past mistakes. Every trader makes losing trades, but smart traders study those mistakes to avoid repeating them.

Keeping a trading journal helps you track what went right and wrong in each trade. Review your journal weekly or monthly to identify patterns in your mistakes. This way, you can adjust your strategies and improve over time.

✔️ What to Record in a Trading Journal:

- Entry and exit points

- Market conditions at the time of the trade

- Reason for entering the trade

- Profit or loss result

- What you learned from the trade

By consistently learning from your mistakes, you’ll make smarter decisions and protect your trading capital.

6. Focus on High-Probability Setups Only

One of the simple strategies to avoid losses in trading is to only trade setups with a high chance of success. Many beginners lose money by chasing random opportunities without clear signals. Not every price movement is a good trade.

High-probability setups are those that match your trading plan, follow market trends, and are confirmed by multiple technical indicators or patterns. Trading fewer but smarter setups protects your capital and increases your win rate.

✔️ How to Spot High-Probability Setups:

- Look for clear trend directions (uptrend or downtrend).

- Use confirmation indicators like RSI, moving averages, or MACD.

- Trade breakouts with strong volume, not weak pullbacks.

- Wait for candlestick patterns like double tops, head and shoulders, or bullish engulfing candles.

By waiting for the right opportunities, you reduce unnecessary risks and increase your chances of profitable trades.

7. Keep Learning & Stay Updated

Markets are always changing, and one of the most important simple strategies to avoid losses in trading is to never stop learning. If you use outdated strategies, you risk making poor trading decisions that could cost you money.

Successful traders regularly study new trading techniques, market updates, and economic news. Staying informed helps you adjust your strategies to changing market conditions and avoid unexpected losses.

✔️ Ways to Keep Learning and Stay Updated:

- Follow trusted financial news sources like Bloomberg, Reuters, or TradingView.

- Take online courses on trading strategies and risk management.

- Join trading communities and forums to exchange ideas and tips.

- Subscribe to market analysis newsletters or podcasts.

The more you learn, the more confident and prepared you’ll be when making trading decisions.

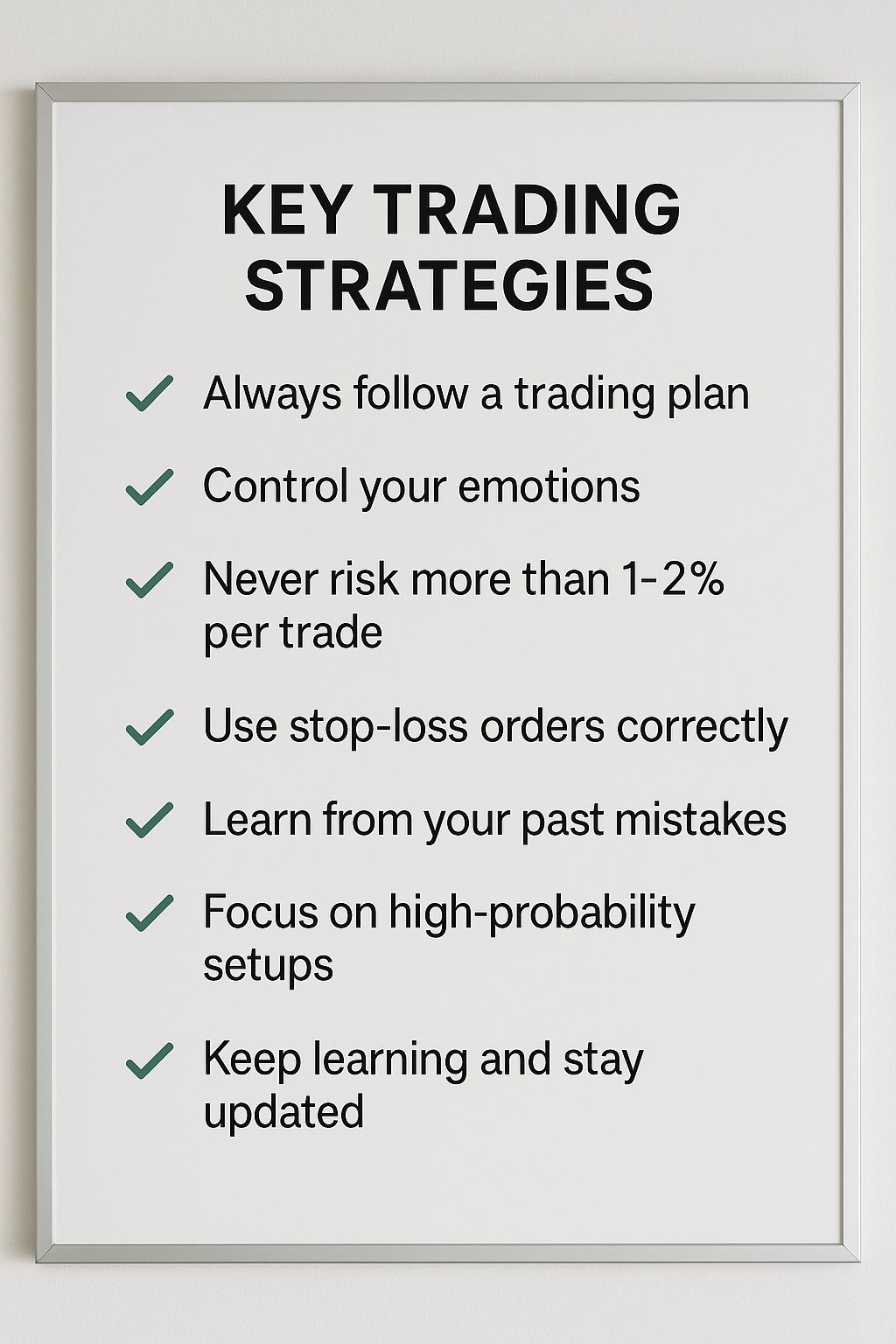

Key Takeaways

Here are the most important simple strategies to avoid losses in trading. Keep these points in mind every time you trade:

- ✅ Always follow a clear trading plan to guide your actions.

- ✅ Control your emotions and stay disciplined, even when trades don’t go your way.

- ✅ Never risk more than 1–2% of your capital on a single trade.

- ✅ Use stop-loss orders correctly to protect your funds from large losses.

- ✅ Learn from your past mistakes by keeping a trading journal.

- ✅ Focus on high-probability setups and avoid chasing random trades.

- ✅ Keep learning and stay updated with market news and strategies.

By applying these simple yet powerful strategies, beginner traders can protect their capital and increase their chances of long-term success.

FAQs About Avoiding Losses in Trading

Q1: What are the most effective simple strategies to avoid losses in trading?

The most effective strategies include using a trading plan, applying stop-loss orders, managing risk, controlling emotions, and learning from mistakes. These help protect your capital and improve decision-making.

Q2: Can beginners avoid trading losses completely?

No, losses are part of trading. But by using simple strategies to avoid losses in trading, beginners can minimize their losses and protect their money while they learn.

Q3: How much of my capital should I risk per trade?

Risk only 1–2% of your total trading capital per trade. This limits your losses and helps you stay in the game longer.

Q4: Why is emotional control important in trading?

Emotions like fear and greed cause impulsive trades and poor risk decisions. Staying calm and following your plan helps you avoid emotional mistakes.

Q5: Do I need to update my trading strategy over time?

Yes. Markets change, so traders should regularly update their strategies and stay informed about new market conditions and tools.

Recommended Reading

Want to learn more beyond these simple strategies to avoid losses in trading? Here are some helpful articles to continue your learning journey:

- 🔗 How to Manage Risk in Forex Trading (2025 Beginner’s Guide)

- 🔗 Top Trading Psychology Tips for Beginners

- 🔗 Best Crypto Trading Platforms for Beginners (2025 Review)

- 🔗 Simple Risk Management Tools Every Trader Should Use

- 🔗 Common Forex Trading Mistakes Beginners Make and How to Avoid Them

Bookmark these guides to strengthen your trading skills and stay on top of market trends.

Conclusion

Avoiding losses in trading is not about finding a secret formula—it’s about following the basics consistently. By applying these simple strategies to avoid losses in trading, such as creating a solid trading plan, managing your risk, and keeping your emotions in check, you’ll build a strong foundation for success.

Remember, every trader faces losses, but smart traders learn from them and improve. Stay patient, keep learning, and follow your plan. Over time, you’ll gain the confidence and skills needed to trade smarter and protect your money in any market.

➡️ Ready to take your trading to the next level? Start applying these strategies today and turn your losses into valuable lessons.